A brief hiscrolly of Bitcoin

2009-2012:From humble beginnings

On 22/5/2010, the first bitcoin transaction occured in Florida. Its value was negotiated by individuals on the bitcoin forum. Ultimately, a man was able to purchase two Papa John's pizzas for 10.000 BTC. The value of the pizzas was 25$.That transaction essentially established the initial real-world price or value of bitcoin at 4 bitcoins per penny.

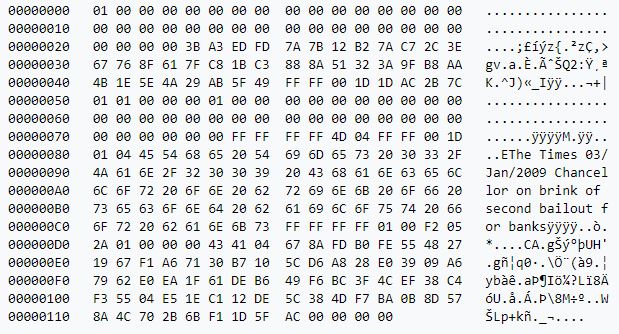

Bitcoin was created in 2009 as the first decentralized currency to run on Blockchain technology. It was introduced in a white paper published by someone with the pseudoname Satoshi Nakamoto. Bitcoin would allow users to conduct transactions based on digital signatures and coins. On 3/1/2009, the bitcoin network came into existence with Satoshi Nakamoto mining the genesis block of bitcoin (shown below). At that time, Bitcoin had no real monetary value.

Since then, Bitcoin slowly but steadily became more popular. In 2010 it became easier to buy, sell and trade. More and more organsations started accepting Bitcoin as a payment method. These include E.F.F, a non-profit group, Wikileaks and WordPress. The increased amount of exchanges helped Bitcoin to be priced against the U.S dollar. By the end of April 2011, one BTC was equal to 1$.

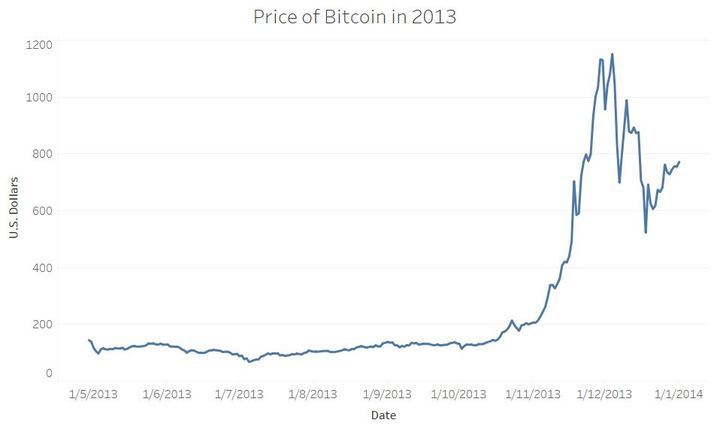

2013:Birth of a titan

2013 proved to be a decisive year for Bitcoin's price. The digital currency began the year trading at 13.40$. From there, its price rose steadily, reching an all time high of 220$. However, when payment processors BitInstant and Mt.Gox experienced processing delays due to insufficient capacity, its price radically declined, dropping to 76$. This drop was very temporary, as it returned to 160$ within a day. Nonetheless, this was its first price bubble. During mid and late 2013, even more companies and organisations started accepting it. Aditionally, many countries such as the U.S.A and Germany starting passing legislations and acknowledging it as a form of currency.

In October 2013 the FBI seized roughly 26,000 BTC from website Silk Road, inadvertently linking Bitcoin (and other cryptocurrencies) to illegal activities. Even though this could lead to a price drop,a rally occurred, partially fueled by the launch of the first BTC ATMs and its acceptance by Chinese Internet giant Baihu. By December, it had spiked to 1156$. But when Alan Greenspan, economist and Chair of the Federal Reserve, referred to it as a "bubble", its price would crash once more.

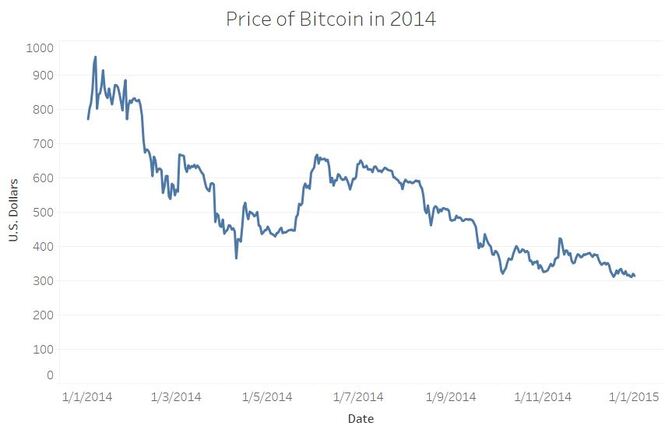

2014:A losing battle?

The beginning of 2014 seemed promising for Bitcoin as it was steadily growing once again. However, everything was about to crash. Mt Gox, a large crypto exchange, claimed That 744.000 bitcoins (worth 480 million dollars at that time) had been stolen. It filled for bankruptcy and started liquidating its assets in April 2014.From 1 February 2014 until the end of March, during the period of Mt. Gox problems, the value of bitcoin declined by 36%.And yet, there was still hope. Huge corporations like Microsoft and Zynga started accepting bitcoins for their services and assets, keeping its price above 300$.

2015-2016: The slump years

History has a way of repeating itself and just like Mt.Gox, another huge Bitcoin exchange based in Luxembourg, called Bitstamp had 19.000 bitcoins stolen. As a result, its services were suspended for a week and bitcoins price fell to less than 200$. Even though many nobel winners denounced Bitcoin, more computer scientists and programmers started getting interested in investing on it. The academic papers about Bitcoin had grown from 424 in 2012 to 3580 in 2016.

2017 boom and 2018 crash

The start of 2017 was extremely promising for Bitcoin. In March of 2017 the price of one bitcoin has surpassed the value of an ounce of gold for the first time.Then, something phenomenal happened. In just a few monts, Bitcoin reached its peak price of 19.497$. Although it is currently unkown why this surge happened, it is speculated that it was caused by market manipulation and a cryptocurrency "whale" (a huge investor). However, just like the internet bubble of the 2000's, the bubble burst and its price dropped to 6.955$ in the beginning of February 2018. The volatility of its price lead to an exodus, further decreasing its value.

The current state

During 2019 Bitcoins price increased slowly but steadily. In 26/6/2019 it reached 13.016$ and hopes of another surge were rekindled. However, this never happened. Bitcoin closed the year with a value of 6.985$. In early 2020, just as the economy was shutting down due to the pandemic, Bitcoins's price dropped by 50% in just a few days. However, this loss would be restored by mid 2020. In 16/12/2020 Bitcoin closed the market at 21.311$ reaching an all time high. Ultimately, in early 2021 Bitcoin's price witnessed another boom and in 21/2/2021 had a price of 57.540$.

The future of Bitcoin

But what does the future of Bitcoin hold? No one knows for certain. There are those who claim that another crush is imminent, just like 2017. But the popular opinion is different and economists claim that its price will grow steadily and surpass the 6-digit limit by 2022.